Office Supplies and Office Expenses on Your Business Taxes

By A Mystery Man Writer

Description

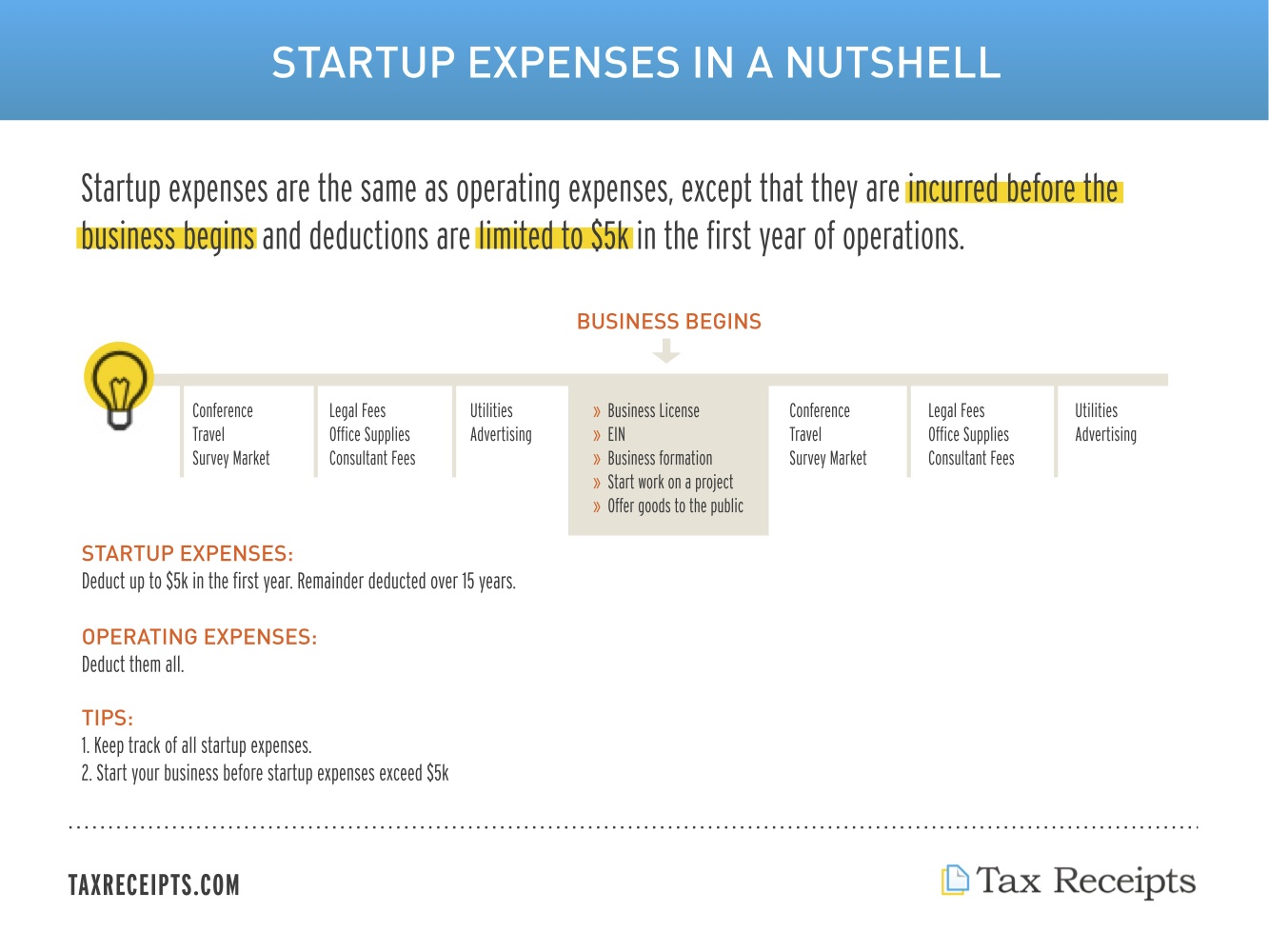

Deducting office supplies and office expenses, the new simpler IRS rule for expensing rather than depreciating, and where to put on your tax return.

Can I Claim Office Furniture on My Taxes? What You Need to Know

The Top 25 Small Business Tax Deductions

How To File And Pay Small Business Taxes

20 Small Business Tax Deductions to Know: Free 2022 Checklist

:max_bytes(150000):strip_icc()/small-business-owener-1057253610-61b725a228fa43488f4bf1fcf2272abf.jpg)

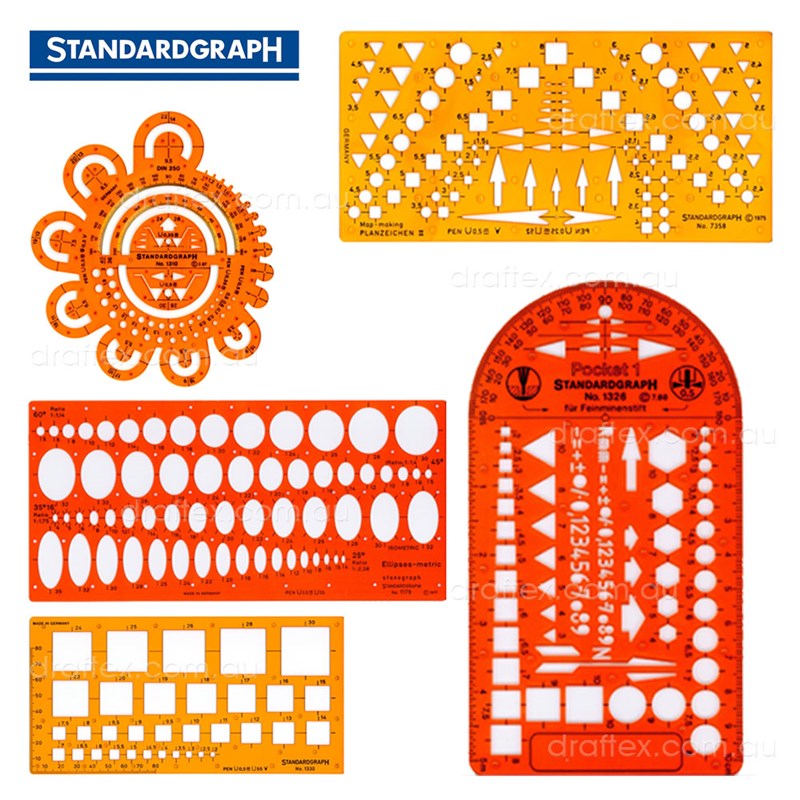

Business Equipment vs. Supplies for Tax Deductions

office supplies expenses - The Bottom Line Group

Home Business Tax Deductions: Keep What You Earn by Stephen

What Are Business Expenses? Examples, Tips and FAQs

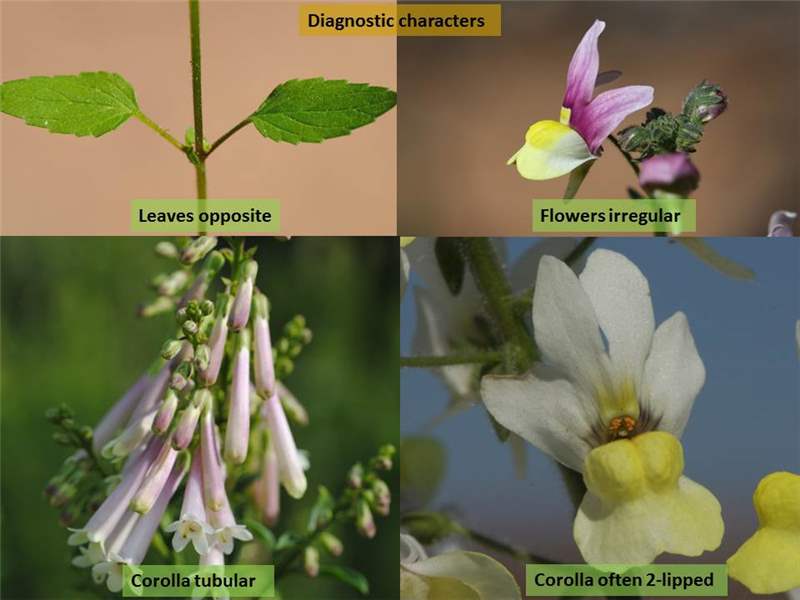

Scrophularia An Overview ScienceDirect Topics

The Definitive Guide to Common Business Deductions

Deduct It!: Lower Your Small Business Taxes eBook by Stephen

Scrophularia An Overview ScienceDirect Topics

Home Office Deductions and Expenses: How and What to Claim—Wave

Office Expense Vs. Supplies for a Business

from

per adult (price varies by group size)

:strip_icc()/Organized-desk-office-supplies-102148148-2db86810329942a68a623066406a474d.jpg)