Daycare Tax Deductions: Save Big with IRS-Approved Benefits

By A Mystery Man Writer

Description

Discover essential daycare tax deductions for your daycare business, from travel expenses to childcare supplies. Get IRS-approved tips to maximize savings.

Child and Dependent Care Credit: Definition, How to Claim - NerdWallet

Resource Hub

Top 10 Tax Deductions for Childcare Businesses - Honest Buck Accounting

M.S.B Financial Solutions

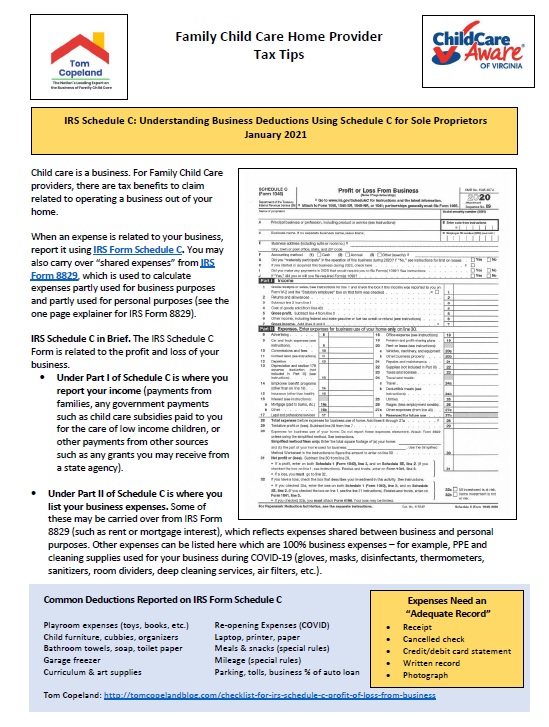

CCAVA FCC Business Support

How big will your tax refund be? Changes this year make it harder to guess

Home Daycare Tax Deductions for Child Care Providers - Where Imagination Grows

Day care tax credit: What is it and how can it benefit you? - Resources

Daycare Tax Deductions: Save Big with IRS-Approved Benefits

How to take advantage of the expanded tax credit for child care costs

Taxes

IRS clarifies payment plans for expanded child tax credit, unemployment deductions as part of stimulus - That's Rich!

As child tax credits expire, here's how families used the money for 'survival

Tax Forms IRS Tax Forms

from

per adult (price varies by group size)